Choosing a home loan is about far more than simply securing the lowest interest rate. The structure of your loan and the features attached to it can have a significant long-term impact on how much interest you pay, how flexible your loan is, and how well it aligns with your financial goals.

In this guide, we break down the most common home loan features used in Australia and explain how they work, who they suit best, and what to consider before choosing them.

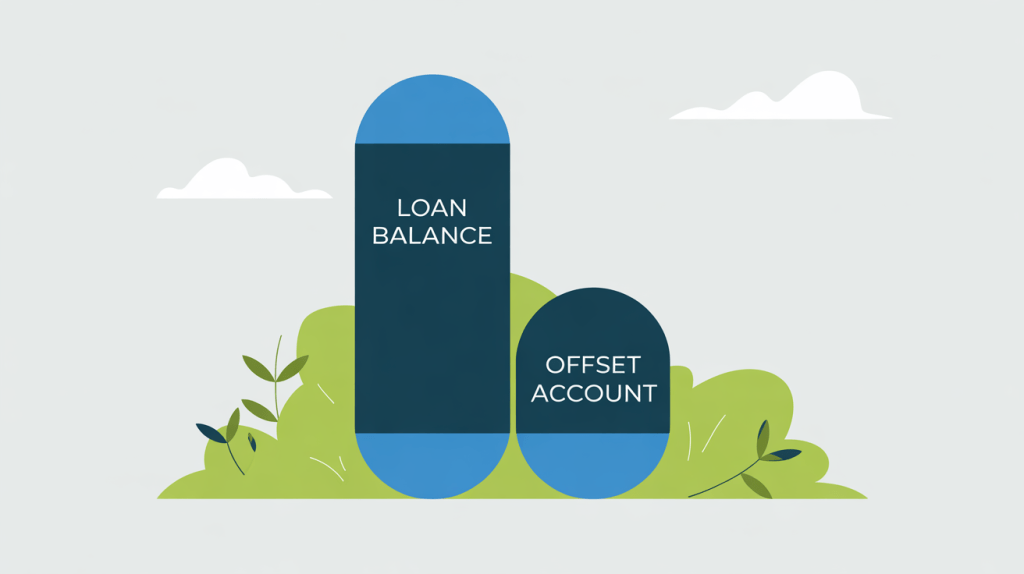

Offset Accounts Explained

An offset account is a transaction account that is linked to your home loan. The balance of the offset account is “offset” against your loan balance when interest is calculated.

How it works:

If you have a $500,000 home loan and $50,000 sitting in an offset account, interest is only charged on $450,000.

Key benefits:

- Reduces interest without locking money away

- Funds remain fully accessible

- Can save tens of thousands of dollars over the life of the loan

- Often tax-effective for owner-occupiers

Things to be aware of:

- Loans with offset accounts may have slightly higher interest rates

- Some lenders offer partial offsets (e.g. 40% or 50%)

- Offset accounts are usually best for borrowers with surplus cash flow

Best suited for:

Owner-occupiers, PAYG earners, professionals, investors who are cash heavy, and borrowers who regularly maintain savings.

Redraw Facilities Explained

A redraw facility allows you to make extra repayments on your loan and then withdraw those extra funds later if needed.

How it works:

If your required repayment is $2,500 per month and you pay $3,000, the additional $500 may be available for redraw.

Key benefits:

- Reduces interest by lowering the loan balance

- Simple way to get ahead on repayments

- Often included at no additional cost

Potential drawbacks:

- Funds are not guaranteed to be accessible

- Lenders can reduce or freeze redraw at their discretion

- Redrawn funds may have tax implications for investment loans

Best suited for:

Borrowers who want flexibility but don’t need instant access to savings.

Offset vs Redraw: Which Is Better?

| Feature | Offset Account | Redraw |

|---|---|---|

| Access to funds | Immediate | Subject to lender |

| Interest savings | Yes | Yes |

| Tax effectiveness | Strong | Can be complex |

| Cost | May cost more | Often free |

In many cases, offset accounts offer superior flexibility, particularly for owner-occupiers and investors planning future purchases.

Fixed Rate Home Loans

A fixed rate loan locks in your interest rate for a set period, typically between one and five years.

Advantages:

- Repayment certainty

- Protection against interest rate rises

- Easier budgeting

Limitations:

- Limited extra repayments

- No or restricted offset accounts

- Break costs if you refinance or sell early

Best suited for:

Borrowers who value certainty and are comfortable with reduced flexibility.

Variable Rate Home Loans

A variable rate loan moves with market interest rates and generally offers more flexibility.

Advantages:

- Access to offset and redraw

- Ability to refinance without break costs

- Benefit from rate reductions

Risks:

- Repayments may increase

- Budgeting requires more buffer

Best suited for:

Borrowers seeking flexibility and long-term interest minimisation.

Split Loans: A Strategic Option

Many borrowers choose to split their loan into fixed and variable portions, combining certainty with flexibility.

Example:

50% fixed for stability, 50% variable with offset for savings.

This strategy can be particularly effective during uncertain rate environments.

There is no universally “best” home loan feature — only what works best for your circumstances. Choosing the right combination of features can significantly reduce interest, improve cash flow, and give you flexibility as your life changes.

A mortgage broker can help tailor a loan structure that aligns with both your current needs and long-term goals. As a broker who owns his own business I am around for the long term. Reach out today if you are wanting to review your structure or know someone who needs to.

Joshua Beniston

Leave a comment